Libertex Reviews Read Customer Service Reviews of libertex com 5 of 62

Contents:

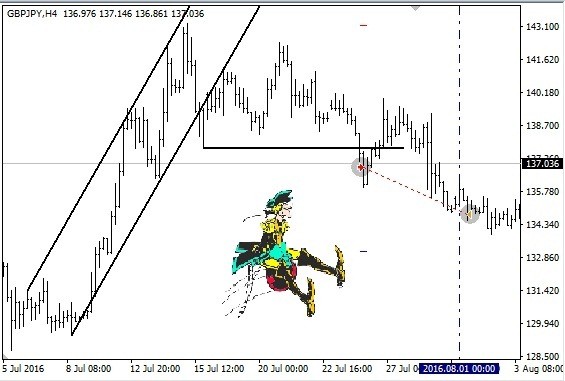

It is well known for its user-friendly interface and built in trading tools. It is simple enough to use for novice traders whilst providing enough functionality for the more advanced traders. I like how the platform can be fully customised depending on how simplistic or complicated you need it to be. The possibilities are endless in terms of market analysis and trading strategies.

F you’re wondering what is Libertex, their supported markets and products, fees and trading platform features, regulatory status and more, read this Libertex review. The videos are annotated and easy to digest, suitable for all levels of traders. There is also a trading glossary that covers a range of trading terms and definitions. I think there should be more than enough here for beginners to get their teeth stuck into.

Libertex is regulated by CySEC and does not offer a Bonus, due to the regulator’s advice, expressed through Circular C168. Withdrawals are easy and instant but can take up to 2-5 business days, depending on the withdrawal method. We recommend reading the Libertex terms and conditions for additional details.

Deposits and Withdrwals

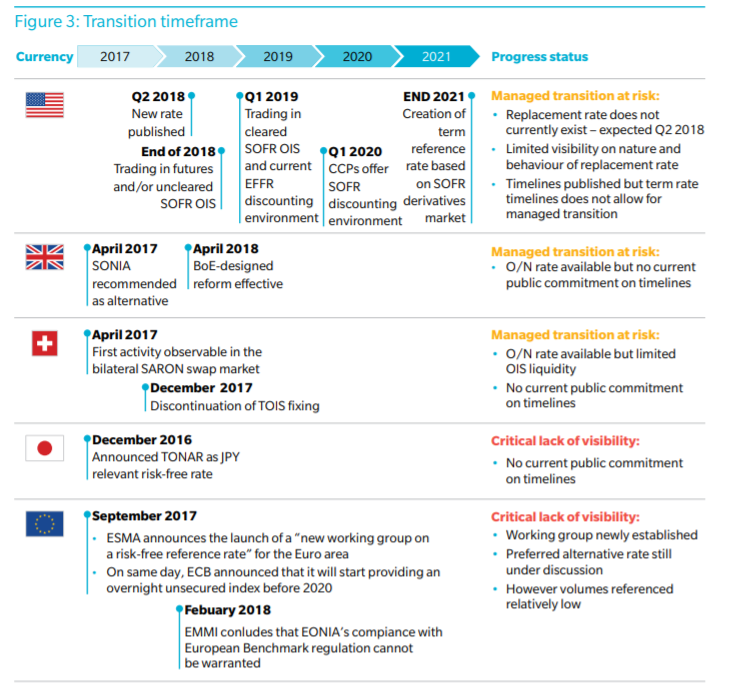

2) Libertex has recently introduced obligatory stop-loss limits, stating it was necessary due to ESMA-regulations on CFD’s . Although other brokers (who have no obligatory stop-loss) told me the only necessity is to introduce a 50% margin close-out rule, Libertex told me they had no other choice. However it may be, as a result, when trading on Libertex, your trade gets an automatic stop-loss . This makes, at least to me, the trading at Libertex more risky, because it’s hard to be certain that a trade won’t drop with 5% or 10% before it goes up with 40%. It offers a “credit facility” to increase its initial margin in view of being able to open positions with a larger volume than that proposed by the ESMA regulations. It is a pass-through, which circumvents the rules, so that the private investor can invest more, without margin restriction.

- Click the fund your account and choose your preferred payment method.

- As with currency exchange markets, commodity markets offer different investment opportunities for traders.

- I like the trading experience at Libertex due to its competitive, commission-free trading costs for Crypto CFD trading and its superb cryptocurrency CFDs selection.

- The impact of economic releases on the price of a given asset is underscored in a sentence or two.

- The videos are annotated and easy to digest, suitable for all levels of traders.

- The customer base is not only made up forexperienced investors and traders, but also for beginners.

The platform incorporates 43 different indicators separated into three categories – oscillators, volatility-based and trend-based. Regardless of whether the market is ranging or trending, traders can choose from a wide range of tools for all types of market environments. To make sense of the underlying price action, traders use chart tools to discern determinate price formations against the background market noise. A chart’s tools and features determine its functionality. The seamless design of Libertex’s platform makes it arguably easier to use than MT4 and MT5, however, it lacks some of the features available in its more popular counterparts. Namely, one-click trading, social and automated trading.

Money disappeared from my account

I started trading a few hours ago and it was a very exciting experience for me. I have to mention that Libertex offer a very professional, well structured platform for a successful handling for different operations in the very complexed world of finance. Compare the markets and instruments offered by Libertex and its competitors. Please note, some markets may only be available via CFDs or other derivatives. Commission levels are attractive, and a unique platform full of features allows clients to trade whenever they want.

- We do not provide financial advice, offer or make solicitation of any investments.

- This will probably speed up the registration process and ensure that you can go through the registration process without any problems.

- The non-fx instruments are also not as extensive as some other brokers.

- I always recommend that traders check them before evaluating the total trading costs.

https://forexhero.info/ does not charge internal deposit fees, but applies withdrawal costs on several payment processors, and traders should also consider any applicable third-party charges. The minimum deposit required to open an account is €100. Processing times vary from instant to five business days, payment processor dependent. Traders may open a demo account directly from the MT4/MT5 trading platforms, and I did not find a time limit or any other restrictions, which is good.

We check these factors and others so you know what to expect when trading with this broker. Libertex offers over 200 OTC derivatives that can be traded as CFDs, including options. Investors can also purchase stocks from the platform and build a portfolio. The broker charges a commission of 0.003 EUR per 1000 EUR of traded volume on instruments from all asset classes, except for cryptocurrencies.

Most deposits are processed instantaneously, while withdrawals take 1 to 3 business days to complete. The broker does not charge anything for deposits, but third-party fees may apply for withdrawals. Libertex offers as well one of the most popular professional trading platforms.This platform is MetaTrader 4 . It offers CFD on more than 43 currency pairs and 100 effective trading tools. This platform is free to download and is available on the official website of Libertex. MT4 is famous for its good indicators and good functions, and no wonder a good broker like Libertex chose this platform.

This company is deceptive and I strongly advise that you do not open an account with them.

Trading with CFD options requires a deep understanding of how derivatives work, but if done correctly, it can give traders certain control over their positions. Libertex is a platform on which seasoned traders can thus construct complex positions on characteristically volatile instruments. IG Group – IG offer spread betting, CFD and Forex trading across a range of markets. They are FCA regulated, boast a great trading app and have over 47 year track record of excellence. In our opinion, Libertex is one of the brokers in the trading industry that is inexpensive. There are also no hidden fees and the broker is very transparent with regard to the fees to its customers.

Beginner traders have free access to lessons about the basics of trading. Other than that, Libertex lacks a lot of important educational material. No, Libertex is a modern online broker that allows its users to trade CFDs. With the help of Libertex, traders can trade many different commodities and also speculate on price developments.

I have not bought any crypto’s yet from…

Libertex does not provide any research tools on its website, however, the MetaTrader platforms come with a very comprehensive suite of charting and analytical tools. Still, many brokers do provide research tools as an added benefit to their clients. Traders often seek out brokers which provide a decent research offering, as proper analytical tools can play a key role in executing profitable trades on the often volatile Forex market. Libertex offers several ways for clients to contact its support team, including through Whatsapp, Messenger, and Live Chat. There is also the option of a query submission for less pressing issues, and the website is available in multiple languages.

I am libertex review at Forex Club for 5 years and I can to recommend this company. There are no supporting videos, and the educational course more closely resembles a glossary. There are only a few articles on Libertex’s blog, and the broker is no longer publishing new webinars. Indication Investments Ltd. accepts traders who are citizens of countries within the European Economic Area and Switzerland.

Libertex gives users access to their unique trading platform. It is entirely web-based and does not require any downloads. The Libertex platform runs well and works seamlessly in any online browser, with a user-friendly interface. (Applies to clients with a total account balance less than 5000 euros . At Libertex, the selection of tradable currency pairs is large and not only the usual constellations such as USD/EUR have to be traded.

We would like to list the most popular CFDs on commodities offered by Libertex. On the other hand, Libertex Pty., is a South African financial services provider and is regulated and supervised by the Financial Sector Conduct with FSP Number 47381. To allow your trading positions to extend beyond normal trading hours, an overnight financing fee, also known as swaps, is charged. CFD derivatives are leveraged financial instruments and can attract interest. For this reason, Libertex charges so-called commission fees. The commission depends on the base value and can start from 0.0003%.

City Index Review – Public Finance International

City Index Review.

Posted: Tue, 17 Jan 2023 08:00:00 GMT [source]

Most brokers usually have several account types with different features in order to cater to the needs of a greater number of traders with different goals, needs, and means on the market. Therefore, it is a trader’s responsibility to pick the account type that best matches their approach to trading. Libertex was awarded an average mark in the Deposit and Withdrawal category. The broker has a wide range of payment methods, including credit, and debit cards, wire transfers and e-wallets. Traders do not have to wait long for their transactions to be processed, and the broker does not charge anything for deposits. Libertex’s spreads on some of the most widely traded currency pairs are quite low.

Libertex Bonus

I like the fact that Libertex is part of the Forex Club Group, which has been active for a long time and I also like their platform. I know I said previously that it’s more complicated than a regular binary options platform but that doesn’t mean it’s bad . Also, Libertex offers Trading Central analysis right on the platform, which is another plus. The trading style is different than some of us might be used to. The leverage is not set by the platform but instead, the trader will have to choose a Multiplier .

Binary Options Signals – Public Finance International

Binary Options Signals.

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

It goes against our guidelines to offer incentives for reviews. We also ensure all reviews are published without moderation. We use dedicated people and clever technology to safeguard our platform. Companies can ask for reviews via automatic invitations.

Best PAMM Accounts Forex Brokers Reviewed – Public Finance International

Best PAMM Accounts Forex Brokers Reviewed.

Posted: Mon, 13 Feb 2023 08:00:00 GMT [source]

More than 250 underlying assets are available on Libertex that are categorized into stocks, forex, indices, commodities like gold, energy, and agriculture), cryptocurrencies, and ETFs. This number is comparatively lower than other CFD brokers like Libertex, which is a severe disadvantage for it. Deposits made by Visa or Mastercards are processed instantly. For withdrawal funds using Visa, a withdrawal fee of €1 per transaction is charged from the traders, and the processing requires a maximum of 5 days. Deposits made via bank wire transfers take 3-5 days for processing There is a 0.5% fee charged as the withdrawal fee on the amount withdrawn (0.5% min 2 EUR, max 10 EUR).

The broker also provides excellent customer support and a fair amount of analytical materials, scoring average in the Research category. Libertex also scored above average in the Fees category due to its competitive spreads. However, bank transfers could take several hours on occasion.

The information that Trading Central gived me was the key to understand how i should see trading. Providers starting to block this site, App Store already delete Libertex App. It’s hard to believe managers, because their company is out of law. 40 cryptocurrencies pairs including Bitcoin, Bitcoin Cash, Litecoin, Ethereum, and Ripple. I provided the documents in timely matter the same day they requested them.

The Libertex platform can be accessed via dedicated mobile apps for iOS and Android devices. These can be downloaded via the Apple App store and Google Play Store respectively. The Libertex platform runs smoothly in any web browser, complete with a user friendly interface to facilitate all operations.