The price for the trailer must be separately stated on the invoice for the boat or other vessel or the entire sales price will be subject to the full Sales Tax rate. The partial Sales Tax exemption and the $20,000 Sales Tax cap apply to sales, leases, and rentals of personal watercraft. You should submit a copy of the lease purchase agreement that indicates the buyout figure and the amount of tax paid by the lessee. As a sole proprietor you would not have to pay any additional tax on that transfer.

Is the IRS really texting you? No, it’s one of many tax scams. – Detroit Free Press

Is the IRS really texting you? No, it’s one of many tax scams..

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

There is no provision for ACH Credit payers to initiate the payment through the online filing system. Only ACH Debit registrants can complete the EFT transaction online. If you are registered for ACH Credit, please use your regular EFT method of payment to initiate your payment transaction. Generate your crypto gains, losses, and income reports in any currency. These reports can be used to complete the relevant tax forms for your country. The Self-Employed edition is the upper end of TurboTax’s online programs.

Opposition to return-free filing

https://1investing.in/ normally releases its new versions as soon as the IRS completes revisions to the forms and approves the TurboTax versions, usually late in the tax year. The process is similar for states that collect income taxes. E-filing is the fastest way to file your return and receive your refund.

Book Depository is shutting down amidst Amazon layoffs – AOL

Book Depository is shutting down amidst Amazon layoffs.

Posted: Wed, 05 Apr 2023 07:00:00 GMT [source]

The new agreement, struck between the IRS and the alliance in 2005, gave Intuit what it had sought. Companies were now expressly barred from offering free tax prep to everyone through the program. Instead, only taxpayers under an income cap, then $50,000 a year, would be eligible. In 2021, some individuals who used Turbotax for their tax filings were unable to access stimulus checks sent by the government because Turbotax diverted the checks to old and unused bank accounts for the customers. Typically, TurboTax federal software is released late in the year and the state software is released mid-January to mid-February.

Sales and Use

The present value formula reported this year that TurboTax online had handled 32 million returns. In a statement, it said around a third of that number used Free Edition. Another celebrated feature, former staffers said, were the animations that appear as TurboTax users prepare their returns. The danger to Intuit’s growing business was obvious. If the government succeeded in creating a system that allowed the vast majority of taxpayers to file online for free, TurboTax profits would plummet.

- The company recently announced it made $1.5 billion in profits for its fiscal year.

- “My TurboTax expert helped me step by step and made sure I had help any time I needed. I felt so much confidence doing my taxes online for the first time.”

- Mass.gov® is a registered service mark of the Commonwealth of Massachusetts.

- With CoinLedger, you can calculate your crypto taxes in 3 easy steps.

The company recently announced it made $1.5 billion in profits for its fiscal year. It expects its TurboTax unit to grow by 10% next year. A few days later, Ryan arrived at the IRS’ Constitution Avenue headquarters in Washington to mount a defense of the program.

Approved Software

Like the Premium version, the Premium & Business edition also includes support for rental property owners. Many personal tax preparation services still use a format similar to the one TurboTax introduced for its desktop software in 1993, and with good reason. It works beautifully, saving time, easing frustration, and dramatically reducing errors.

The partial Sales Tax exemption and the $20,000 Sales Tax cap apply to commercial and noncommercial boats and other vessels. Yes, Sales and Use Tax would be due on the purchase of the kit and all accessories. No tax is due if the corporation was dissolved before the transfer and the vehicle was transferred to a stockholder as a liquidating dividend. If that is the case, submit a copy of the tax clearance certificate. Cryptocurrency Tax Loss Harvesting | How To Save on Your Tax Bill Everything you need to know to get started with tax-loss harvesting and save money on your crypto tax bill.

Activity Feed

The Self-Employed version also gives you access to a TurboTax product specialist who can guide you through preparing your return. This edition not only searches more than 500 deductions and credits; it also shows you all the potential deductions for a new business to ensure the maximum return on your startup expenses. You enter a few details about your financial life to get an estimate of your tax refund.

If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax Live Business or TurboTax Live Full Service Business federal and/or state purchase price paid. On January 21, 2009, TurboTax received considerable public attention at the Senate confirmation hearing of Timothy F. Geithner to be the United States Secretary of Treasury. Geithner made it clear that he took responsibility for the error, which was discovered in a subsequent IRS audit, and did not blame TurboTax. Intuit responded by releasing a statement saying “TurboTax, and all software and in-person tax preparation services, base their calculations on the information users provide when completing their returns.”

“This means no more worry, no more waste of time, no more extra expense for a tax preparer,” he declared. NCDOR encourages taxpayers to use electronic filing rather than paper filing. E-filing ensures a faster refund and is the most secure way to file.Paper returns will not be processed earlier than electronic returns. If your adjusted gross income was $73,000 or less, review each provider’s offer to make sure you qualify. All features, services, support, prices, offers, terms and conditions are subject to change without notice.

Complete the Questionnaire and Affidavit along with attaching any supporting documentation of the transfer. You should check the appropriate box on the Questionnaire , complete the Purchaser’s Affidavit, and enclose a copy of the will. If there is a lien on the vehicle then tax is due on the principal loan amount assumed. Effective January 1, 2018, the Sales Tax rate is 6.625% on the purchase price of a new or used vehicle. When the amount due for any monthly period covered by Form ST-51 is $500 or less, you do not need to file a monthly return.

A bill called the Taxpayer First Act was sailing toward almost unanimous approval in Congress. But after ProPublica published a series of stories about the program, including a story showing that military families and students were particularly affected by Intuit’s business tactics, the bill stalled. Congress ultimately removed the provision that would have enshrined Free File in law.

It turns out when she put in her info at TurboTax, she ended up in its more expensive version, even though she met the income threshold fore free filing. We don’t edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information.

San Diego-Based TurboTax at Center of FTC Suit: Is Intuit Fleecing … – Times of San Diego

San Diego-Based TurboTax at Center of FTC Suit: Is Intuit Fleecing ….

Posted: Mon, 11 Apr 2022 07:00:00 GMT [source]

Use the resources below or call to find a trusted free tax preparation program near you. Intuit’s TurboTax family of personal tax preparation software and services has a history of excellence that goes back more than 30 years, and this year’s product line continues that tradition. TurboTax packs a lot of substance and style into its products. It offers thorough coverage of tax topics in an easy-to-follow interview format, and its support is top-notch. For many years, it’s come out on top of our reviews of the best personal tax preparation services.

- On December 12, 2008, the company announced that it had rescinded the new policy.

- If the broker simply connects the buyer and the seller for a fee, the buyer pays the seller directly and the airplane had been purchased for the seller’s own use.

- Effective January 1, 2018, the Sales Tax rate is 6.625% on the purchase price of a new or used vehicle.

- Allow business days from the beginning date for the new account for the revision request to be to be processed.

- FreeTaxUSA and Cash App Taxes are still totally free for federal filing, though FreeTaxUSA charges $14.99 for state returns.

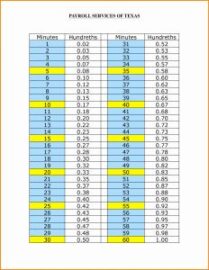

Payment for that month must be made with the next quarterly return, Form ST-50. New Jersey tax table and tax rate schedules used to calculate the amount of Income Tax due on returns. In addition, if your Pennsylvania employer did not withhold New Jersey Income Tax, you must pay the amount due to New Jersey and you may be required to make estimated tax payments.

This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. Intuit’s QuickBooks accounting product remains a steady moneymaker, but in the past two decades TurboTax, its tax preparation product, has driven the company’s steadily growing profits and made it a Wall Street phenom. When Smith took over in 2008, TurboTax was a market leader, but only a small portion of Americans filed their taxes online. By 2019, nearly 40% of U.S. taxpayers filed online and some 40 million of them did so with TurboTax, far more than with any other product.